UNDERSTANDING TAX PRORATION

The purpose of Tax Proration in a sale escrow is to fairly divide property expenditures, such as taxes, between the Seller and Buyer so that each party is paying only for those days which they own the property.

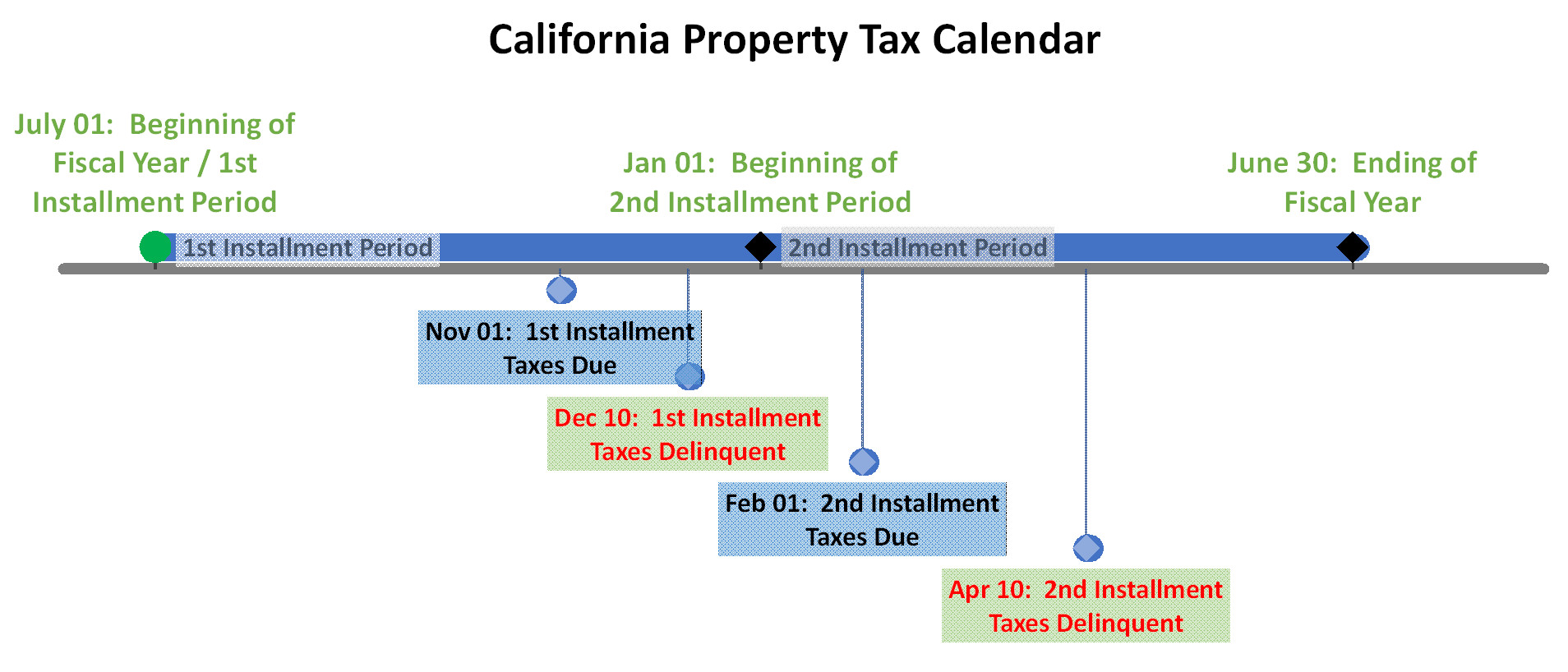

Understanding the Tax Calendar:

The fiscal tax year does not follow the standard calendar year. It runs from July 1 to Jun 30 (of the following year) and is divided into two installments. Taxes are due in November and February.

Who pays the taxes?

At closing, if the Seller has not yet made a payment which is due, the Seller is charged with the amount of the installment.

If the lender in the transaction requires that a future tax payment be made, this payment is a charge to the account of the Buyer. The Seller is only responsible for making tax payments that come due during the time period that the Seller owns the property.

On the day of closing, the Buyer is the owner of the property, and the Buyer is responsible for tax bills that come due on or after that date.

How is the tax proration figured? The first step is to determine the date to which the taxes are paid.

If the Seller (or escrow holder) pays (or paid) the 1st half, then taxes are paid to January 1.

If the Seller (or escrow holder) pays (or paid) the 2nd half, then taxes are paid to July 1.

If the Seller’s last tax payment covered a time period beyond the close of escrow, the proration is made from the close of escrow to the date to which the taxes are paid. The proration is a credit to the Seller and a charge to the

Buyer.

Supplemental Property Taxes

If you recently purchased a home, in addition to annual taxes, you will be responsible for paying supplemental property taxes. The supplemental property tax covers the difference between your purchase price and the sellers purchase price and will be prorated based on the number of months remaining until the end of the fiscal tax year, June 30th. This bill is sent to the new owner after escrow closes - it is NOT prorated in escrow.

This is for reference only, always verify exact figures for your specific escrow.